Traditionally the vast majority of us in Sooke have paid the piper by the early July property tax deadline. This year, 6,237 tax notices were distributed, and I'm told the District's front office team of Cassidy Thagard, Chandra Frobel, Stacey Dalep, Teresa Burkett and Deborah Knight again came through with flying colours in dealing respectfully and professionally with the paperwork crush as well as the occasional (happily rare) aggrieved resident steamed about this year's hike.

I'm not sure where I saw the following number recently, but I believe the stats show that the Sooke tax base is 85 percent residential. The District continues to face growing costs of doing business, so obviously this and future councils will need to be assertive and creative in encouraging more industrial and commercial tax folios ~ most logically through ...

* the long overdue hiring of an Economic Development Officer;

* the relaunch of some fresh variation on the Sooke Economic Development Commission to liaise with the Sooke Chamber of Commerce (now undergoing another of its periodic transitional phases) and the smaller, more nimble Economic Development Group (given that it's a group of local business people who focus in collegial fashion on specific projects ~ #DividedBy14 originally and now the Municipal Regional Development Tax to finally get Sooke fully into the tourism marketing game). Sooke's EDC was established in the mid-00s by Mayor Evans complete with an 'Advantage Sooke' website. It was replaced by Mayor Milne in 2012 with the Advisory Panel on Economic Development, RIP 2015. (One participant in the Steve Grundy-led panel, Michael Clouser, wrote a comprehensive overview of local and regional ED initiatives following council's 2015/16 decision to opt out of participation in what has evolved into the South Island Prosperity Project.)

* and, perhaps most sensibly if we want to boost business/commercial taxes and create local jobs, extend the sewer system across the Sooke River to service underdeveloped industrially zoned lands (in addition to the the First Nation, two schools and residential areas with failing septic systems in the Kaltasin area). This proposal was one of the top-two next-step (along with Whiffin Spit North) recommendations for future sewer development in Sooke's 2010 Liquid Waste Management Plan (Sanitary). It will only be possible once we've dramatically upgraded and doubled the capacity of the existing wastewater treatment system, currently at close to 70 percent capacity and prone to possible spillovers during winter's heavy rainfalls. There's also the option of a satellite waste treatment site on the east side of the river. Or perhaps we simply accept the fact that we're a bedroom community and leave it at that ... much discussion sure to follow, maybe complete with the revival of WRATH (Worried Residents Against Tax Hikes), which rallied against the establishment of a sewer system back in the early '00s.

Okay, all this said, back to my abandoned and now revived post from the late winter/early spring. Bonus: A few musical selections ~ #1 ... #2 ... #3 ~ as accompaniment if you choose to read on.

Here's a collection of point-form notes arising from the 2019 Five-Year Budget Planning session. Bottom line: Taxpayers across all nine property classes of taxation will pay 7.2 percent more this year. For homeowners, that works out to $7.28 per month on residences with an assessed value of $481k (the average for Sooke homes in 2019 as determined by BC Assessment) or $87.41 for the year.

The District snags approx. 40 percent of your total tax bill. The rest is collected on behalf of the Capital Regional District, School District #62, BC Transit, the Regional Hospital District and the Vancouver Island Regional Library. Use this Sooke tax calculator on the District's website to see how your 2019 property bill is divvied up for municipal services. And check out these Union of BC Municipalities fact sheets -- Local Government Revenues & Expenses + Property Assessment + Taxation + Financial Planning & Accounting -- for the big-picture story on how municipalities collect, manage and spend.

Our Sooke tax hike will deliver the following ...

* The hiring of six new municipal employees (1.9 percent tax increase for a partial year of salaries) deemed to be essential in building a professional municipal operation and aiding existing staff manage the workload here in Van Isle's second-fastest growing community ...

~ Career Firefighter

~ Municipal Engineer (a position vacant locally since 2015)

~ Records Management Clerk

~ Chief Building Official

~ Permit/Plan Coordinator

~ Waste Water Operator

* Payment for consultants and the full public engagement processes for a set of documents that will redefine Sooke's masterplan for the next decade, namely ...

~ Official Community Plan (budgeted for $200k over three years)

~ Staff Organizational Review ($50k, to be helmed by our next Chief Administrative Officer)

~ Parks & Trails Masterplan ($71k)

~ Transportation Masterplan ($100k)

~ Housing Needs Assessment ($35k)

~ Child Care Needs Assessment (paid for through a provincial grant)

~ CAO Executive Search ($20k)

~ Lot A Planning ($25k)

* Employer Health Tax ~ 1.06 percent tax increase. The District has traditionally paid $30k roughly in Medical Service Plan premiums to cover health plans for its employees. The DOS this year has to pay that amount plus $81k of the new employer health tax. Next year and beyond, we're on the hook for just the employer health tax.

* Road Maintenance Contract ~ 1.3 percent tax increase likely this year. The District's contract with Main Road is up for renewal. (Update: The RFP for submissions is Aug. 23). Given local growth and regional cost increases, it's expected we could be paying as much as $100k more for the contract. The time will eventually come when the District creates its own works department or in some future amalgamated partnership with other west shore communities.

* Paid On-Call Volunteer Firefighter Wages ~ This year will see the first in a phased series of pay increases to align local practices with provincial standards as championed by the Volunteer Firefighters Association of BC. It's a critical next step in ensuring retention of the volunteer force (currently three dozen, which is a dozen or so short of Chief Mount's optimal roster) that backs up our small team of career firefighters.

* Debt Servicing- $129K (1.6 percent tax increase). We have a number of loans through the Municipal Finance Authority still outstanding, including the sewer, Lot A (for which we'll be paying down $284k + $9k interest this year), and some necessary equipment upgrades for the Fire Department (ladder truck, water tender truck and, new this year, a replacement for Engine 3, which will be purchased in $400k instalments this year and next).

* Road Improvement Program - budgeted at $800k. Year two of the five-year program is $100k more than anticipated in last year's budget, a reflection of increased costs on the south island.

* EV Charger Program ~ $75k (1 percent tax increase). Click for details.

* Mayor and Council Salary increase ~ $20k (0.25 tax increase) to boost our salaries in a first pay hike since the automatic annual cost-of-living bump was eliminated in 2011 (by a council comprised of folks with good salaries and healthy pension plans, it must be said. To reiterate, this increase will bring us closer to the average for BC commuities of our size and is a first step in encouraging gifted and engaged young and mid-to-late career individuals to run).

You're entirely free and welcome to disagree, of course, but the belief of council and staff is that this tax increase is necessary. We're growing like topsy out here and the District must keep pace. The last two councils kept tax increases low ~ artifically so, one might argue. The key positions of Director of Planning and Municipal Engineer were left unfilled when the incumbents left in 2014 and 2015 respectively.

Mayor Milne campaigned on cost-cutting and he delivered with a cumulative 1.61 percent increase over his three years. The last four years, meanwhile, has seen a total increase of 9 percent. That's a 10.83 increase since 2012 ~ barely enough to keep pace with the Consumer Price Index. Meanwhile, the demands on staff, infrastructure and services have grown exponentially. As those of us who attended the recent Local Government Leadership Academy sessions in Parksville learned, zero tax increases are fine and dandy in the short term yet the deferred costs can only be kicked down the road so often before the cracks show and the potholes multiply.

FYI Here's how the tax increase numbers break down over the last seven years:

2018 2.79%

2017 5.58%

2016 0.85%

2015 0.00%

2014 0.02%

2013 1.59%

2012 0.00%

Perspective: Other municipalities have also set significant tax increases this year, including Kelowna (4.43%), Tofino (7.4%), Duncan (3.89%), Saanich (5.37%), Victoria (4.3%) and Vancouver (4.5%) . Here's a municipal tax calculator for 160+ BC municipalities (2018 figures).

Reality check: Property tax increases are just one measure of living costs, and costs are up in many areas of life, especially here in lotus land. The Consumer Price Index rose nearly 2 percent in the Victoria region compared to last year. BC Consumer Price Index stats can be found here. Compare then and now with this British Columbia Inflation Calculator (i.e., $100 CAD in 1960 would be worth $867.74 CAD in 2019.)

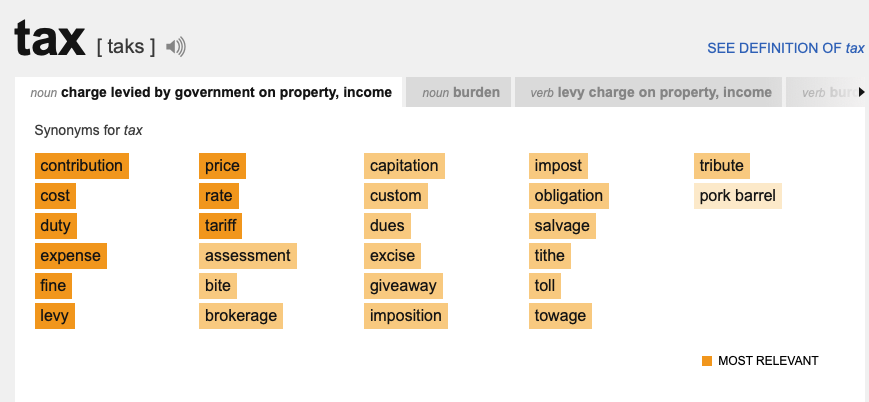

Closing words courtesy Grumpy Taxpayers of Greater Victoria. Plus these thoughts on taxation from American linguist George Lakoff, who discusses the differences in how taxes are framed as either a necessity that supports civilized life as we know it here in this privileged part of the world ... or a burden from which relief is needed ... depending on whether one's mindset is progressive or conservative. The key, far smarter and accomplished people than me have said repeatedly, is that tax dollars be spent wisely and strategically for the betterment of communities. Hopefully that's what we're accomplishing here in Sooke.

RSS Feed

RSS Feed